Vedanta Limited is one of the world’s foremost natural resources conglomerates, with primary interests in zinc-lead-silver, iron ore, steel, copper, aluminium, power, oil and gas. With world-class, low-cost, long-life strategic assets based in India and Africa, we are rightly positioned to create long-term value with superior cash flows.

Direct and indirect employment

Natural resources company in India

By DJSI in Asia Pacific in the metal & mining sector

Nand Ghars created for social welfare

tCO2e in avoided emissions from 2012 baseline

Total contribution to the national exchequer in the past 10 years

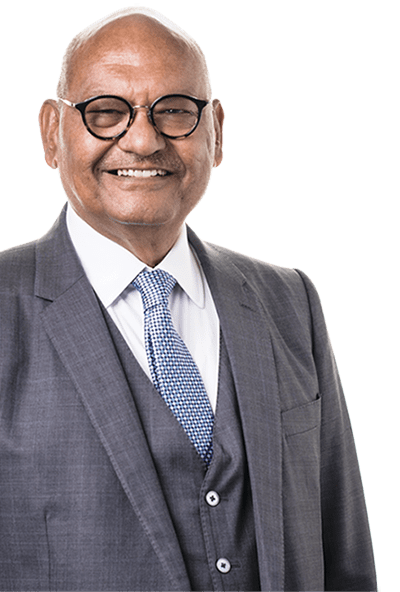

DEAR STAKEHOLDERS,

The year 2020 was a very unusual year for all of us. A year that was challenging on multiple fronts, but what stood out was the extraordinary resilience and adaptability of individuals and enterprises. There was a tectonic shift in the way we live or conduct our businesses, and Vedanta was no different.

Anil Agarwal,

Chairman

Read More

DEAR STAKEHOLDERS,

I am happy to report that our intrinsic spirit to do more and serve more helped us navigate the crisis with confidence in FY2021, which truly tested our mettle. In a year abound with changes and challenges, our performance was exemplary by any measure.

Sunil Duggal,

Chief Executive Officer

Read More

Non-Executive Chairman

Executive Vice Chairman

Non-Executive Independent Director

Non-Executive Independent Director

Whole-Time Director & Chief Executive Officer

Non-Executive Independent Director

Non-Executive Independent Director

Non-Executive Non-Independent Director

As part of our long-term roadmap, we have five strategic focus areas along which we determine our progress and deliver consistent stakeholder value. They are intricately linked to our material issues, opportunity landscape and risk management protocol, and hence form a key part of our integrated decision-making process. Progress and outlook across each of these focus areas have been summarised below.

Read MoreVedanta is India’s largest natural resources conglomerate with leading

positions in seven

key business segments.

At Vedanta, our sustainability approach is driven by the overarching desire to address the expectations of our stakeholders, while delivering strong business performance. As one of the world's leading diversified natural resource companies with business operations in multiple geographies spanning continents, we are mindful of our commitments to society, our people and the environment.

Read More