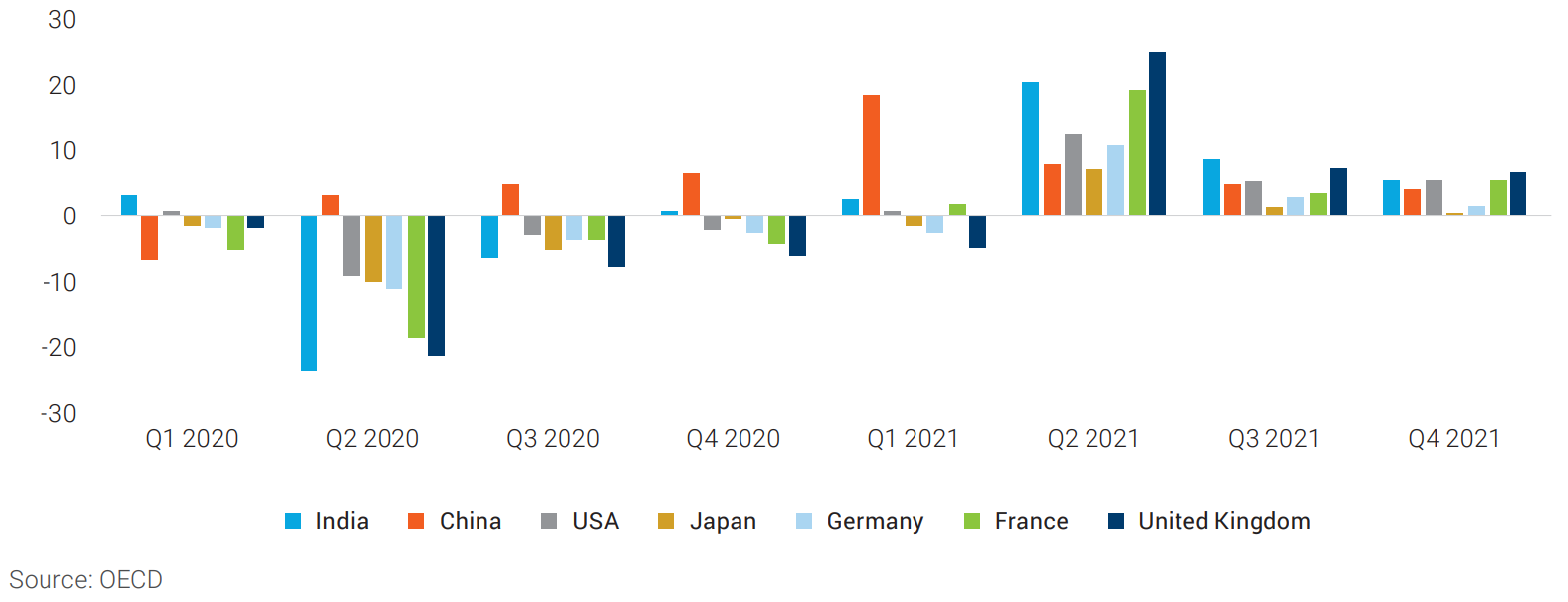

After contracting sharply by -3.4% in pandemic-hit 2020, the world economy is estimated to have grown 5.5% in 2021 – the strongest post-recession recovery over more than last eight decades, as per World Bank. The International Monetary Fund (IMF) also estimated a global economic growth of 6.1% in 2021, driven by the widespread vaccination rollout across countries and policy support to counter the socio-economic impact of the pandemic. With countries relaxing lockdowns, demand for goods and services too received a boost, leading to a sharp uptick in global trade. Notwithstanding logistical bottlenecks, global trade reached a record level of about US$28.5 trillion in 2021, nearly 25% higher than 2020, and close to 13% increase over the pre-pandemic level of 2019.

However, new mutations of the coronavirus caused fresh outbreaks in 2021, leading to mobility disruptions. A slowdown in industry operations, port lockdowns, shortage in shipping containers, unfavourable weather conditions, and backlogs affected global trade. Together, these factors hindered global recovery and created a supply-demand mismatch. Rising inflation, driven by supply side constraints, labour market factors and high commodity prices, created a challenge for governments and industries across countries.

The geopolitical tension between Ukraine and Russia has set back global recovery. Commodity prices reached all time high and are likely to remain uncertain in the short term. Supply chain disruptions intensified further due to the ongoing war. According to IMF, global growth is expected to slow significantly in 2022 to 3.6% from the earlier projections of 4.4%.

The US economy witnessed a growth of 5.7% in 2021, the highest since 1984, indicating its resilient recovery. Generous fiscal stimulus packages have aided this economic recovery but also created challenges like high inflation, which is at a 40-year high due to the supply-demand mismatch and labour shortage. IMF has downgraded the growth prospect of US economy to 3.7% driven by the monetary policy tightening to control inflation and the trade disruption fueled by the Ukraine-Russia war.

The Chinese economy started 2021 on a strong note with the resurgence in global and domestic demand but witnessed challenges in the second half of the year. Disruptions in the real estate sector, the power sector crisis and its impact on industrial production, and the government’s strict Zero-COVID strategy enhanced uncertainties and dampened growth. Low private consumption, withdrawal of private investments and slump in production and economic activities due to the COVID protocols, have had a cascading effect on the economy and impeded its growth prospects in 2022. The growth prospect of China has been revised down to 4.4% in 2022 due to the war affected external demand disruption and stringent COVID protocols.

European Union witnessed record growth in the first half of 2021, following resurgence of domestic demand, modest consumer spending and healthy growth in public and private investment. Rise in COVID-19 infections, high energy prices, particularly that of natural gas, supply chain disruptions together with geopolitical tension between Ukraine and Russia impacted Europe’s economic recovery, leading to uncertainties. The European Commission estimates annual inflation to reach 3.5% in 2022. Inflation rose 4.8% in Q1FY2022, mainly driven by supply bottlenecks, high energy prices in the short term and worsening of the standoff between Ukraine and Russia. Overall, despite challenges caused by supply-chain disruption and high inflation, most economies witnessed modest growth in 2021 due to the low base effect and recovery in economic activities.

(% y-o-y)

Globally, governments and central banks have been vigilant about their strategies to counter inflation given that the factors involved are different from those causing regular cyclical inflation.

Among the global economies, the US witnessed a sharp spike in inflation, which reached 8.5% on a year-on-year basis in March 2022, the highest in four decades. The US Federal Reserve has started to increase interest rates and has made subsequent plans to increase rates multiple times in 2022 to counter rising inflation. It also believes that sufficient time has been provided for the economy to recover from the pandemic.

The European Central Bank has decided to end net asset purchases under the Pandemic Emergency Purchase Program (PEPP) from the third quarter of 2022. Inflation has reached 7.5% in March 2022 driven by the war impacted high energy cost.

The commodity market is expected to face frequent fluctuations until the supply chain disruption is brought under control and demand growth sustains. Commodity prices are expected to remain volatile in 2023 due to counterflowing developments like slowdown in major economies and rising interest rates but high energy prices, resulting into production cut in some parts of the world, particularly Europe and supply chain disruptions. But the outlook remains cautious amid possibility of the continued ill effect of the Ukraine-Russia war, high inflation as well as spread of new variants of the COVID-19 virus.

The World Bank expects the global economy to decelerate to 4.1% in 2022 as a result of continuing pandemic-related uncertainties, diminishing fiscal support from governments and supply chain bottlenecks. Global trade is projected to slow down to 5.8% in 2022.

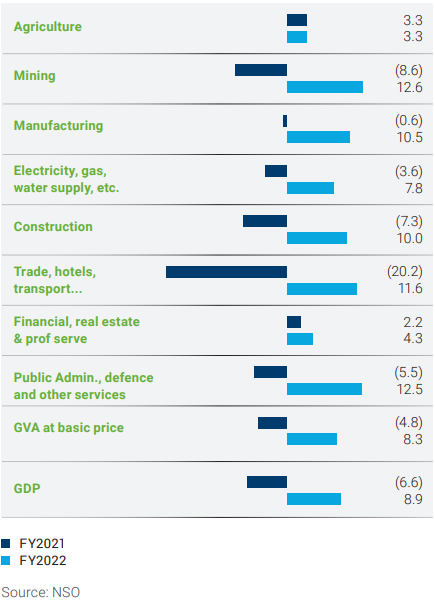

(% y-o-y)

After the downslide in 2020, the Indian economy recovered resiliently in 2021, supported by the largest vaccination drive in the world. Unlike in other economies, India’s supplyside reforms in response to the pandemic not only kept inflation under control but also facilitated long-term growth prospects. Compared to a contraction of 6.6% in FY2021, the Indian economy is expected to grow by 8.9% in FY2022, as per the Second Advance Estimates of National Income of the National Statistical Office (NSO) of India.

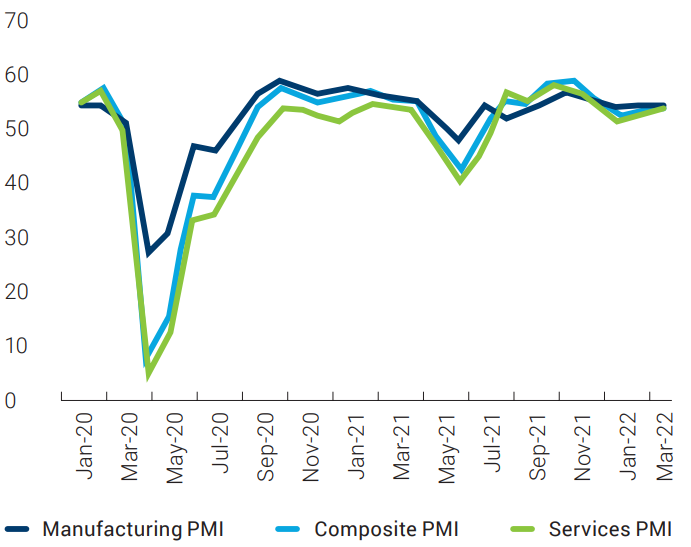

The manufacturing sector saw healthy growth in 2021, with the Purchasing Managers’ Index (PMI) remaining in the expansionary zone (i.e., above 50) levels since Jun’21 despite the challenges caused by the second wave of the pandemic. The service sector is also expected to grow by 8.6% in FY2022 as steady recovery has been observed in service PMI since August’21. The strong support provided by the government’s stimulus packages, increased infrastructure spending and an accommodative monetary policy of the Reserve Bank of India (RBI) have assisted India to sustain its economic recovery

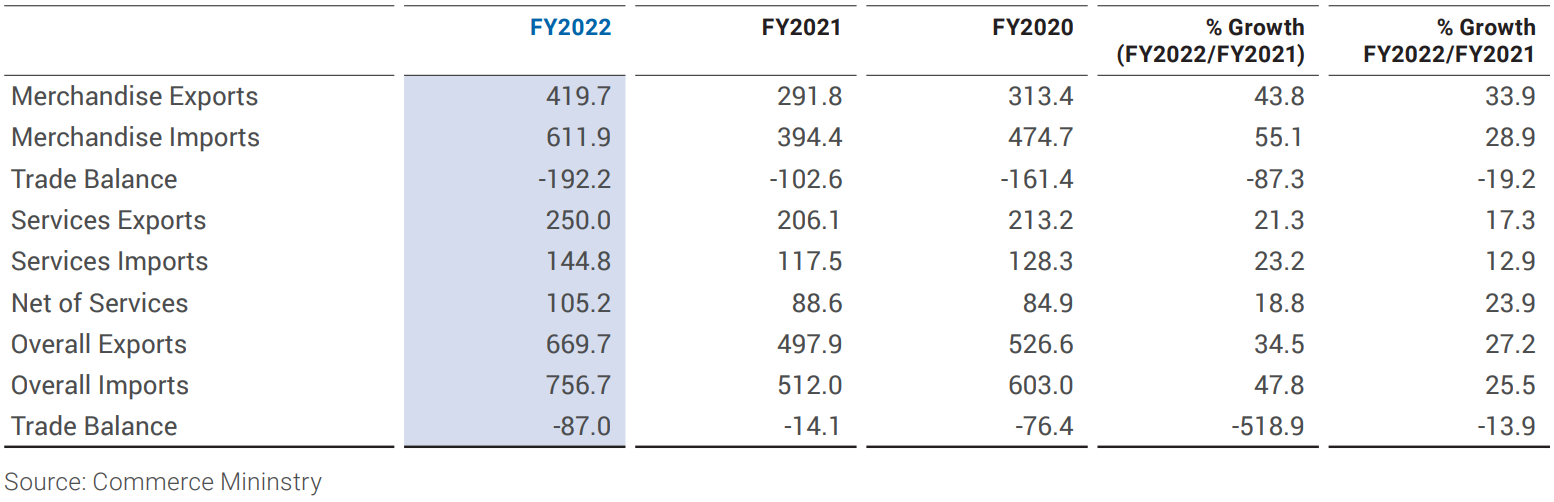

India registered highest ever merchandise exports of US$419.65 billion in FY2022, which is 43.8% higher than FY2021 and 33.9% more as compared to exports made in FY2020. Indian exporters were able to take advantage of global supply disruptions and high commodity prices in the global export market in FY2022. Service exports also grew by 21.3% in FY2022 to reach US$250 billion.

With the signing of new Free Trade Agreements (FTA) with countries like the UAE and Australia and upcoming FTAs with UK, Canada, Israel, EU etc. which are in different stages of negotiations, coupled with Production Linked Incentive (PLI) schemes, India has set the target of US$1 trillion of export of merchandise from India by 2030.

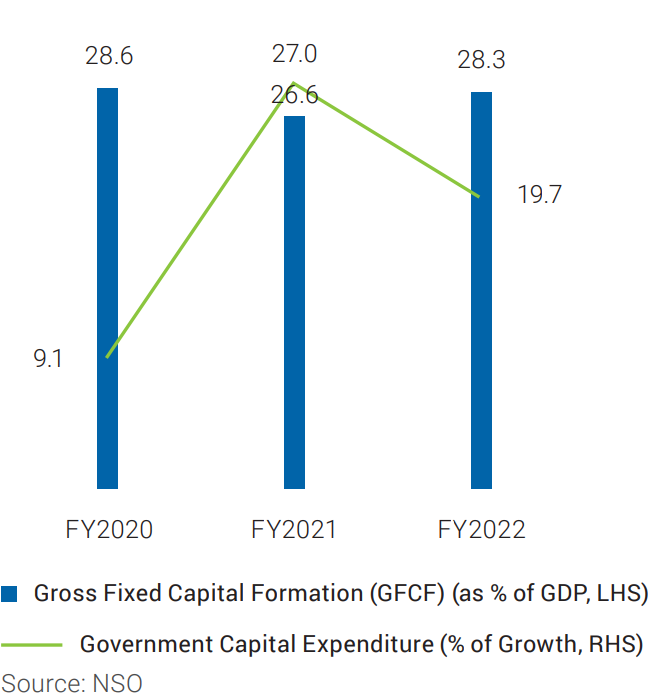

Consumption scenario in India, as indicated by Private Final Consumption Expenditure (PFCE) and Government Final Consumption Expenditure (GFCE) improved in FY2022 from previous year by 16.5% and 12.2%, respectively, though their shares in GDP were down (PFCE: 59.3% in FY2022 vs. 60.8% in FY2021; GFCE: 11.4% in FY2022 vs. 12.1% in FY2021). Overall investment scenario in India, as measured by Gross Fixed Capital Formation (GFCF), improved from 26.6% of GDP in FY2021 to 28.3% of GDP in FY2022. This was mainly backed by continued capital expenditure by the government which grew by 19.7% in FY2022, on the back of 27% in FY2021.

Improvement in economic activity was reflected by massive rise in GST collection which grew by 30.8% in FY2022 to `14,87,313 crore, while March 2022 witnessed the highest ever monthly collection of GST of ` 1,42,095 crore. Non-food credit growth also accelerated for the 11 months in FY2022 to 6.2% as compared to 3.7% during the same period last year

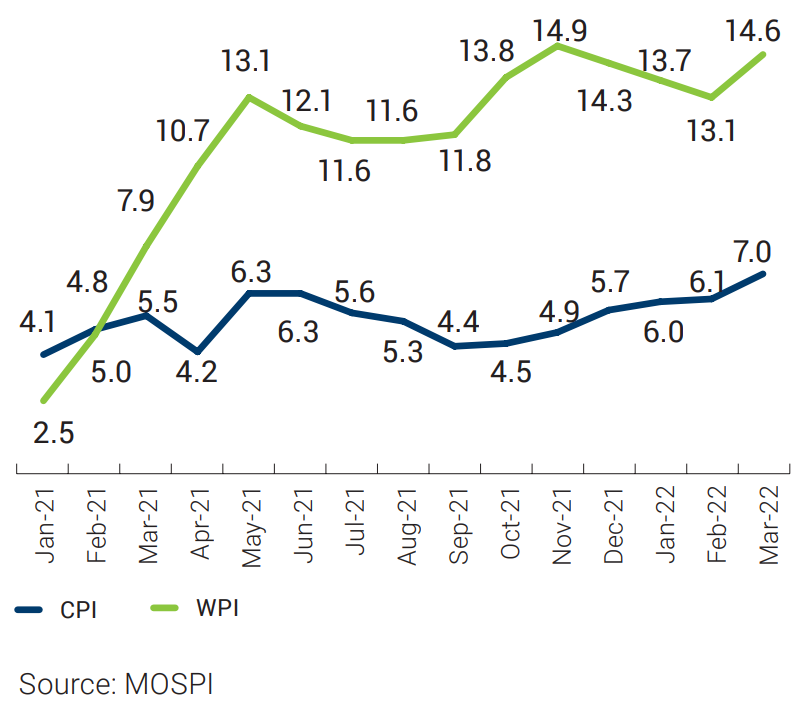

However, India’s inflation rate as measured by Consumer Price Index (CPI) remained high in FY2022, briefly dipping in September 2021 before picking up to 6.95% in March 2022, breaching the upper tolerance limit of 6%. High energy prices, particularly crude oil prices, drove the Wholesale Price Index (WPI) to the second highest level since 2004. The Reserve Bank of India has maintained an accommodative monetary stance, keeping the repo rate unchanged while maintaining a strict watch on the inflation level. Although central banks of some countries have already started considering reversing their pandemic-time expansionary monetary policy by taking a more hawkish stance, the RBI has considered it necessary to retain a commensurate accommodative policy to enable the economy to recover further with focus on keeping inflation in its target range.

(% y-o-y change)

The Government of India has taken various initiatives to make the country a global hub of manufacturing and become globally competitive. For example, the government has rolled out the Production Linked Incentive (PLI) scheme with an outlay of `1.97 lakh crore for 13 sectors. The scheme provides incentives based on the sales value and differential incentive slabs, which are targeted to make India’s domestic manufacturing sector globally competitive, reduce import bills, enhance domestic capacity and export and create as many as 1 crore additional jobs. The National Master Plan of PM Gati Shakti is another initiative that is targeted to ensure seamless connectivity for the movement of people, goods and services from one mode of transport to other, providing last-mile connectivity and reducing travel time for people. This will be achieved through integrated inter-ministerial planning and coordination for infrastructure connectivity projects under a digital platform.

The National Monetisation Pipeline (NMP) again is another initiative which is expected to help efficiently manage public assets and provide benefits to the common public. With a monetisation potential of `6 lakh crore through the utilisation of core assets of the government over FY2022- FY2025, it is projected to bring private investments to provide universal access to high quality and affordable infrastructure to citizens by unlocking the value of investments in brownfield public sector assets.

Many initiatives have also been introduced to facilitate ease of doing business in India. The National Single Window System (NSWS) provides a single platform to enable investors to identify and obtain approvals and clearances needed in India. NSWS will, in effect, help realise the vision of Aatmanirbhar Bharat by not only giving easy access to information about schemes like Make in India, the PLI scheme, Start-up India, etc. but also handholding the investor through the processes in a transparent manner.

Remission of Duties and Taxes on Export Products (RoDTEP) has been introduced to enable refund of currently un-refunded duties/taxes/levies on the production and distribution of the exported product at the central, state and local level. This is expected to encourage domestic players to expand their business internationally. Although certain industries like Iron & Steel, Pharma, Chemicals etc. were left out of the scheme and certain categories of exports like products manufactured or exported by 100% EOU, FTZ, EPZ, SEZ or products manufactured partly or wholly in a bonded warehouse etc. were excluded from the benefit, the government reserves the right to modify any of the categories or industries for inclusion or exclusion under the scope of RoDTEP at a later date based on the recommendations of the RoDTEP Committee.

Amendments in the Mineral Conservation and Development (Amendment) Rules and the Minerals (Other than Atomic and Hydrocarbons Energy Mineral) Concession Rules also contribute to the ease of doing business for mining.

All such initiatives are likely to support the Indian economy get back to a strong growth trajectory and expand demand for minerals, metals and fuel.

India is projected to be the fastest growing major economy in the world in 2022 and 2023

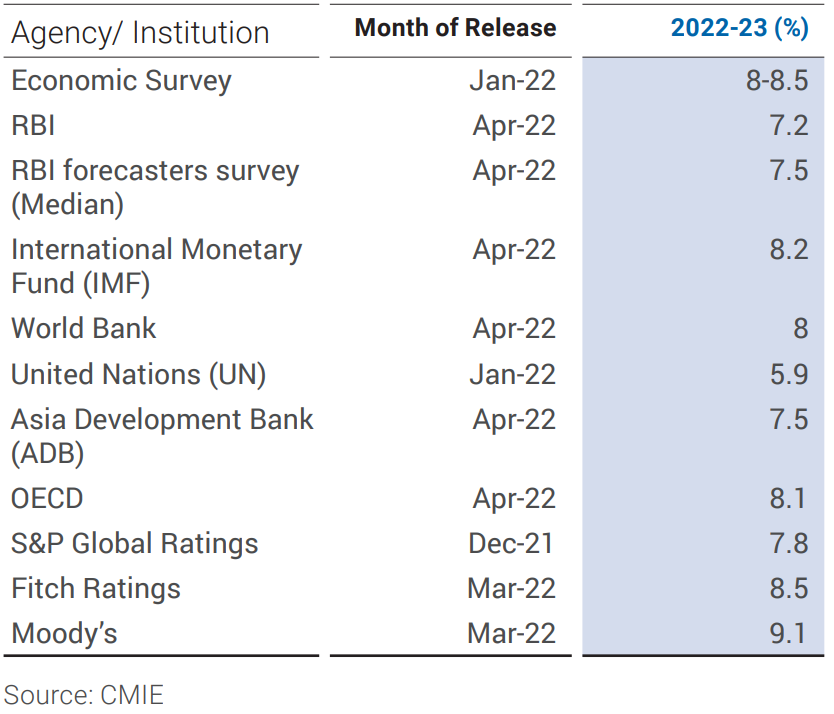

Although the Indian economy made a smart comeback in FY2022, it is likely to face some headwinds in FY2023 due to geopolitical tensons, high commodity prices, supply chain bottlenecks, threat of surging COVID-19 cases and global slowdown. The current war between Ukraine and Russia and the consequent surge in crude oil and other commodity prices have triggered a round of downward revisions in India’s real GDP growth projections by various agencies. The RBI in April 2022, revised down its GDP growth projection for FY2023 to 7.2% from its earlier projection of 7.8%.

The RBI attributed the downward revision in its growth outlook to several factors including escalation of the geopolitical situation and the accompanying surge in international crude oil and other commodity prices, tightening of global financial conditions, persistence of supply-side disruptions, significantly weaker external demand and uncertainties about the pace of monetary policy normalisation in major advanced economies.

The World Bank in April 2022 trimmed down India’s GDP forecast for FY2023 to 8% from 8.7%, while IMF also followed the same by reducing the forecast to 8.2% from earlier 9%, citing worsening supply bottlenecks, higher oil prices which are expected to weigh on private consumption and investment and rising inflation risks caused by Russia’s invasion of Ukraine.

In spite of that, India is projected to be the fastest growing major economy in the world in 2022 and 2023, with IMF estimating its GDP growth to be 8.2% in 2022 and 6.9% in 2023.

The government has also envisaged to expand the National Highways network by 25,000 km, complete 80 lakh houses for the identified eligible beneficiaries of PM Awas Yojana and provide tap water to 3.8 crore households under Har Ghar, Nal Se Jal project in 2022-23.

Economic growth in India is supported by a strong thrust on physical and health infrastructure building. In the Union Budget for FY2023, outlay for capital expenditure sharply increased by 35.4% from `5.54 lakh crore in FY2022 to `7.50 lakh crore in FY2023. The capex provision for FY2023 is projected to be 2.9% of GDP and more than 2.2x the expenditure of FY2020. Along with Grants-in-Aid to States for creation of capital assets, the ‘Effective Capital Expenditure’ of the Central Government is estimated at `10.68 lakh crore in FY2023, which is likely to be around 4.1% of GDP.

In the quarter ended March 2022, India witnessed a big increase in new investment proposals; 660 new project proposals with an investment of `5.1 trillion to create new productive capacities were recorded during the quarter. This is big compared to the average of `3.1 trillion worth of new investment projects that were recorded during the preceding three quarters.

Demand for bank credit has also picked up pace in the last few months. Outstanding non-food credit disbursed by scheduled commercial banks (SCBs) was growing yearon-year at 5.5% at the beginning of FY2022. The growth improved to 6.8% by September 2021 and accelerated further to 8.7% by March 2022.

India’s health infrastructure is also much better equipped to face new waves of COVID-19 cases and accelerated vaccination drive has made the Indian economy resilient to fresh shock

With the government’s focus on self-reliant India backed by supports like PLI scheme and infrastructure spending, the Indian economy is likely to see healthy growth, which augurs well for the metals, mineral and energy sectors.