Capitalising on inherent advantages to deliver long-term value

India’s natural resources industry is likely to contribute substantially to the country’s economy and have a significant impact on the international commodity markets. As India’s largest and most diversified natural resources company, we are poised to play a major role in supporting India’s economic growth. We are making the right investments to grow exponentially, and working with the government to promote inclusive development, raise environmental standards and build public support for the critical minerals and mining sector.

1

World-class natural resources powerhouse with low cost, long-life and diversified asset base

Our large, diversified asset portfolio, with an attractive cost position in many of its core businesses, enables us to deliver strong margins and free cash flows through the commodity cycle. We have an attractive commodity mix, with strong fundamentals and leading demand growth and remain keenly focused on base metals and oil. We also maintained our 1st quartile cost positioning globally across key segments such as Zinc and Aluminium, led by our resolute focus on structural cost reduction and operational efficiencies.

Vedanta continued its strong growth momentum and witnessed steady volume performance across all businesses, with aluminum and zinc delivering record performance.

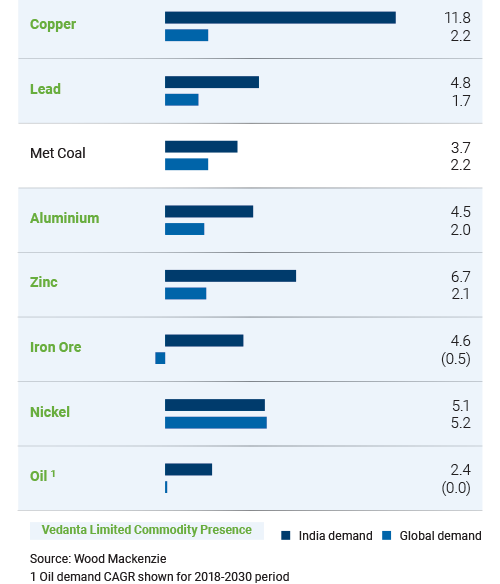

DEMAND 2021-2030 CAGR (%)

2

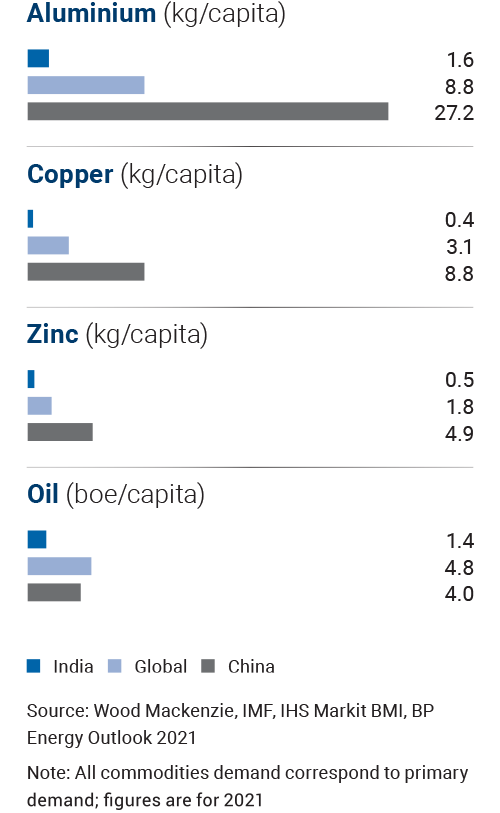

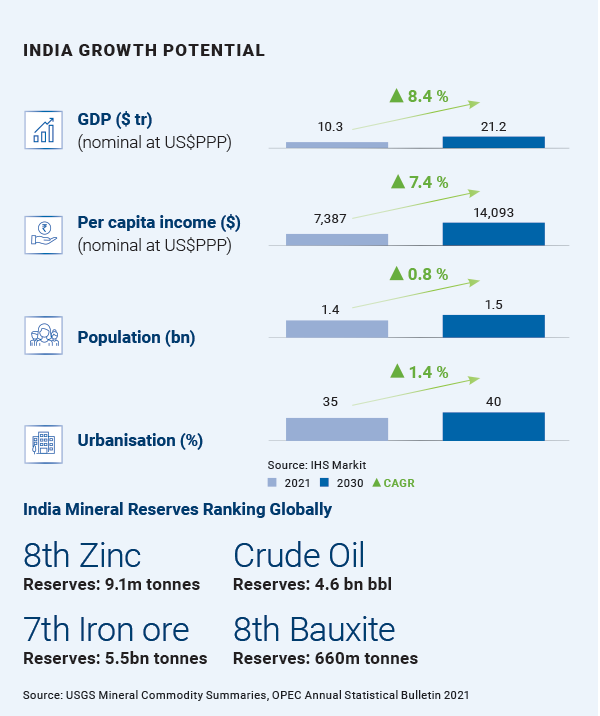

Well placed to contribute to and capitalise on India’s growth and benefit through the cycle with attractive commodity mix

India is our core market and it has a huge growth potential, given that the current per capita metal consumption is significantly lower than the global average. Also India’s GDP, showing strong signs of recovery from 2020, registered a growth of 10.4% over the course of 2021 and is expected to grow 8.2% in the current financial year (IMF; April 2022 estimate) . Urbanisation and industrialisation, supported by government initiatives on infrastructure and housing, a strong response to COVID-19, as well as increase in capital outlay announced in the Union Budget 2022-23, will continue to drive strong economic growth and generate demand for natural resources.

Vedanta’s unique advantages

- Operating a wide and scalable portfolio of commodities that grow the nation

- A strong market position as India’s largest base metals producer and largest private sector oil producer

- An operating team with an extensive track record of executing projects and achieving growth in the Indian geography

CONSUMPTION

3

Proven track record of operational excellence with high productivity and consistent utilisation rates

- Our management team has diverse and extensive sectoral and global experience. Drawing from this deep insight, the team ensures that operations are run efficiently and responsibly

- Disciplined approach to development; growing our production steadily across our operations with focus on operational efficiency and cost savings

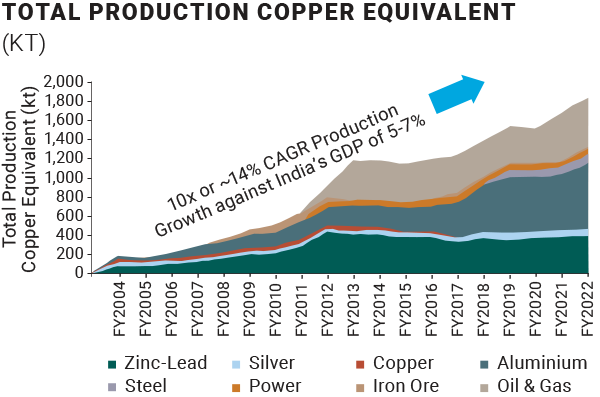

- Since our listing in 2004, our assets have delivered a phenomenal production growth

*All commodity and power capacities rebased to Copper equivalent capacity (defined as production x commodity price / copper price) using average commodity prices for FY2022. Power rebased using FY2022 realisations, Copper custom smelting production rebased at TC/RC for FY2022, Iron ore volumes refers to sales with prices rebased at realized prices for FY2022

4

Focused on digitalisation and innovation to drive efficiency and resilience

To optimise efficiency and ensure future-readiness in everything we do, we are actively investing in Industry 4.0 technologies and mainstreaming a digital-first culture throughout the organisation. This has helped achieve a 100% digitally literate workforce, consistent eye on tech-led innovation, strong collaboration with start-ups and partners and a continued unlocking of efficiency potential across our integrated value chain.

Our key initiative in this direction has been the Disha programme, which aims to transform Vedanta into a data-driven organisation by developing digital dashboards and applying analytics for different verticals, helping the senior management track progress, gather insights, identify issues and bottlenecks proactively. This results in better planning, mitigation and closing the decision loop faster, also enabling regular production monitoring, tracking of KPIs in terms of maintenance and HSE, and in bettering overall predictability.

Another initiative in this direction is Project Pratham, which focuses on significantly improving volume, cost and ease of doing business. This is implemented through global partners by bringing new emerging technologies across the value chain of Vedanta Industry 4.0 framework. Key objectives of this project include EBITDA improvement, gains on intangibles and reducing overall carbon footprint. Apart from our internal digital transformation initiative, we are also leveraging the latest in technology by integrating the start-up culture through the Spark programme.

5

Disciplined capital allocation framework with emphasis on superior and consistent shareholder returns

We have unveiled a structured capital allocation policy that prioritises growth and shareholder returns. The policy aligns to three streams across capital expenditure, dividend policy and selective inorganic growth. It will be driven by a consistent, disciplined, and balanced allocation of capital with long-term balance sheet management, optimal leverage management and maximisation of total shareholder returns.

6

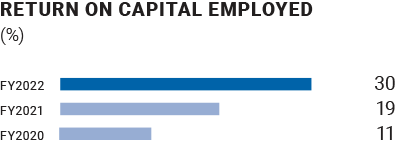

Robust financial profile with improving ROCE, increasing cash flow and a stronger balance sheet

Our operating performance, coupled with optimisation of capital allocation, has helped strengthen our financials.

- Revenues of `131,192 crore and EBITDA of `45,319 crore

- Strong ROCE of ~30%

- Deleveraging and extension of our debt maturities through proactive liability management exercises

- Strong and robust FCF of `21,715 crore

- Cash and liquid investments of `32,130 crore

- A strong balance sheet, with respect to Net Debt/EBITDA (0.5x) and gearing, compared to our global diversified peers

- Interim dividend of ~`16,728 crore paid in FY2022

7

Committed to ESG leadership in the natural resources sector

- Committed to being the lowest cost producer in a sustainable manner

- Committed to incorporating global best practices to transform communities, planet and workplace in alignment to our Group objective of ‘Zero Harm, Zero Waste and Zero Discharge’

- Implemented critical risk management across the business to improve workplace safety

- Committed to promoting diversity in all forms at the workplace and building an inclusive work culture

- Committed to attaining Net Carbon neutrality by 2050 and reducing absolute emissions by 25% by 2030 from 2021 baseline. Decarbonise 100% of our Light Motor Vehicle (LMV) fleet by 2030 and 75% of our mining fleet by 2035.

- Promoting operational efficiency, changing fuel mix, switching to renewable exploring greener businesses opportunities and developing low carbon product portfolio are the levers used.

- Committed to water efficiency and achieving net water positivity by 2030

- Committed to keeping community welfare at the core of decision making by implementing global best practices and becoming a developer of choice

- Committed to positively impacting the lives of 100 million women and children through skilling and education, nutrition and healthcare initiatives

- Committed to improving transparency and completeness of disclosure in alignment with international best practices like GRI, TCFD etc.

Actions taken in FY2022

- Electric mobility: Jharsuguda partners with GEAR India to supply 23 e-forklifts; deployed 50+ EVs at HZL and ESL together

- 10-year MoU signed with TERI to develop implementation programs to further our ESG vision

- Signed PDA for 580 MW RE - a significant step towards 2.5 GW RE commitment

- Launched green Aluminium under the brands ‘Restora’ and ‘Restora Ultra’ to usher new era of green metals

- Collaboration with TUV-SUD to develop roadmap for our ‘Net Water Positive’ initiative

- 1st fly ash rake from Jharsuguda dispatched to cement plant

- Commenced Ash backfilling in one of Coal India’s open-cast mine in March 2022

- Used 17 kt biomass in HZL; committed to using 5% biomass in our thermal power plants

We have adopted the Incident Cause Analysis Method (ICAM) for incident investigation to avoid repeat accidents and promote higher reporting for all incidents.