FY 2024-25 saw significant volatility in LME aluminium prices. Prices stood at ~US$ 2,250/tonne in March 2024, spiked to US$ 2,700/tonne in May following sanctions on Russia, and dropped to US$ 2,200/tonne by July. A reduction in Chinese export rebates in November lifted prices to US$ 2,600/tonne, stabilising around US$ 2,500/tonne by December. Trade measures by the United States further supported a stable trading range of US$ 2,500–2,700/tonne towards year‑end.

In CY 2024, global primary aluminium production rose by 3% Y-o-Y to ~73.0 million tonnes. Demand remained broadly aligned, resulting in a marginal surplus of 0.2 million tonnes. Ex-China, both production and consumption remained flat. In India, demand increased by 10% to ~5.5 million tonnes in FY 2024-25, with primary metal comprising 64% of consumption.

Global aluminium demand is projected to grow at a CAGR of ~3% between 2024 and 2030, supported by decarbonisation trends and the transition to clean energy. Demand from EVs is expected to reach 31.7 million tonnes by 2030, while increased use of aluminium in solar panels and in replacing copper wiring in power infrastructure will drive further growth.

In China, consumption continues to show strength, though long-term growth will depend on sustained activity in transportation and a gradual recovery in construction. For the Rest of the World, modest demand growth is expected in 2025 as inflation moderates, and investment picks up.

India remains a strong demand centre, with domestic consumption expected to grow over 8% in FY 2025-26. Rising demand from sectors such as electronics, appliances, renewables, defence, and aerospace will continue to support this growth.

Vedanta remains India’s largest primary aluminium producer, with an installed capacity of ~2.4 million tonnes. Its portfolio spans ingots, primary foundry alloys, wire rods, billets, and rolled products, catering to sectors including energy, transportation, construction, packaging, aerospace, and defence. The Company achieved a 48% domestic market share in FY 2024-25, with sales volumes rising ~18% Y-o-Y.

Vedanta continued expanding its value-added product (VAP) share, which accounted for ~53% of total global aluminium sales in FY 2024-25 – an 8% increase Y-o-Y. The Company is targeting a 70% VAP share in FY 2025-26.

FY 2024-25 witnessed considerable volatility in zinc prices, driven by macroeconomic headwinds and geopolitical developments. The LME zinc price averaged US$ 2,875 per tonne during the year – marking a 16% rise from FY 2023-24’s average of US$ 2,475 per tonne. Prices peaked at US$ 3,102.91 per tonne in October 2024 before moderating to US$ 2,887.83 per tonne by March 2025. LME warehouse inventories declined to 141 kt and SHFE stocks to 72 kt by March 2025, down significantly from the previous year, indicating tightening market conditions.

Global refined zinc production contracted marginally by 3% to 13,237 kt in CY 2024, compared to 13,712 kt in CY 2023. Meanwhile, demand saw moderate growth, with global refined consumption rising by 1.7% to 13,602 kt, up from 13,369 kt in the previous year. This demand-supply imbalance resulted in a market deficit of 436 kt.

Trade conditions remained complex, shaped by new tariff measures under the US administration, which created uncertainty in global trade and applied pressure on industrial activity, particularly in the US. However, infrastructure-led spending in China and Germany partially offset this impact. Notably, Europe’s zinc demand grew by 3.8% in CY 2024, surpassing earlier expectations. In India, the zinc market continued to demonstrate resilience, registering a 5% increase in demand during CY 2024.

The global zinc market is expected to remain balanced but tight. Refined zinc production is projected to rise by 4% to 13,367 kt in CY 2025, while consumption is anticipated to grow 2% to 13,892 kt. Persisting geopolitical tensions, including those in the Middle East, along with elevated tariffs between the US and China – despite ongoing discussions to lower duties to 10-20% – are likely to keep commodity markets volatile. The US Federal Reserve has kept interest rates steady at 4.25–4.50%, amid gradually easing inflation, which stands at 2.4% but remains sticky at 2.8%.

India’s zinc demand is expected to grow by 5-6% in FY 2025-26, reaching 867 kt, supported by continued urbanisation, infrastructure investments, and increasing household incomes. Key demand drivers include rail modernisation, renewable energy, and rural electrification.

Hindustan Zinc, the world’s largest integrated and India’s only primary zinc producer, maintained its leadership with a 77% domestic market share in FY 2024-25. It achieved record-high domestic zinc sales of 603 kt, up 4% Y-o-Y. The Company also recorded its highest-ever Value‑Added Product (VAP) sales at 179 kt, growing 11% Y-o-Y. Approximately, 73% of refined zinc production was sold domestically, with the balance exported to South-East Asia, the Middle East, the US, and Europe.

The LME lead price closed FY 2024‑25 at US$ 2,002 per tonne, up 2% from US$ 1,965 the previous year. The average price for the year was US$ 2,046 – slightly below FY 2023‑24’s US$ 2,122. Global lead demand remained moderate amid easing inflation, with the IMF forecasting a decline to 4% in 2025, improving real incomes and consumption of lead-intensive goods. However, persistent high interest rates maintained by the Fed and ECB continued to limit investments in key sectors such as automotive.

Industrial activity showed steady recovery: China’s manufacturing expanded by 5% Y-o-Y, US capacity utilisation stabilised at 78%, and Europe saw a rebound in factory output after a mild slowdown. These developments supported lead consumption across batteries, infrastructure, and electronics.

On the supply side, global refined lead production declined 2.1% to 14,205 kt in CY 2024, while consumption fell slightly by 0.7% to 14,151 kt – resulting in a modest surplus of 54 kt.

India’s primary lead demand rose 6-7% during FY 2024-25, supported by growth in automotive, battery, and infrastructure sectors. The shift toward secondary lead gained momentum, now accounting for over 60% of total supply. This was further driven by the removal of customs duties on lead scrap in the FY 2025-26 Union Budget, encouraging formal recycling infrastructure due to its 15-25% cost advantage over primary metal.

Global refined lead production is expected to rise 2.0% to 14,486 kt in CY 2025, while consumption is projected to increase 1.5% to 14,369 kt. In India, the lead consumption landscape is evolving, driven by a 140% Y-o-Y surge in electric vehicle (EV) production, signalling reduced reliance on traditional lead-acid batteries. Policy shifts – such as duty exemptions on lithium-ion battery scrap and critical minerals – are accelerating the transition to alternative chemistries. Indirect tax reforms in the FY 2025‑26 budget are expected to further support domestic manufacturing and export competitiveness.

Hindustan Zinc expanded its primary lead market share to 74% in FY 2024‑25, up from 64% the year prior. The Company sold 166 kt domestically and exported 59 kt. Production continued to focus on 99.99% purity LME-registered lead ingots, with strategic efforts underway to increase domestic offtake and expand customer applications.

FY 2024-25 marked another strong year for silver, with prices reaching a high of US$ 33.40 per Toz in mid‑February – a 16% increase from the December 2024 close of US$ 29. Despite some profit-booking, silver maintained most of its gains, stabilising above US$ 32. Price support came from global macroeconomic uncertainty, largely driven by President Trump’s renewed tariff stance, which sparked record silver deliveries into the US. As a result, CME-approved vault holdings surged past 400 Moz, a 30% increase since the US elections.

India, too, recorded its highest January silver imports since 2008, reflecting strong bullion demand. Meanwhile, London vault inventories declined 9% month-on-month, tightening short-term availability and raising silver leasing rates.

Silver’s dual identity – as both a precious and industrial metal – led to mixed performance drivers. On one hand, gold’s stagflation-fuelled rally pulled silver upwards. On the other, trade war fears weighed on industrial sentiment, tempering investor appetite for base and industrial metals.

Global silver demand is projected to exceed supply for the seventh consecutive year in CY 2025, with demand expected to remain elevated at 1.2 Boz. Supply is forecast to remain flat at 1 Boz, with mine production peaking at 835 Moz, driven by increased base metal activity and new output from US and Canadian mines. However, output is expected to decline beyond 2025 as older mines reach end-of-life, barring new investment decisions.

In CY 2024, silver supply grew by 2% to 1.015 Boz. This was led by a 5% increase in mine production, driven by new mining operations in Mexico and improved yields from Chilean gold mines. Silver recycling added another 200 Moz to the global supply.

Global demand reached a near-record 1.15 Boz, the second highest in history. While jewellery and silverware segments saw modest declines, this was offset by industrial demand, which grew 4% to a record 576 Moz. The rise was driven by increased use in vehicle electrification and EV charging infrastructure.

The silver market outlook for CY 2025 remains strong, underpinned by robust industrial and investment demand. Industrial use reached a record high of 689 million ounces in 2024, driven largely by the photovoltaics (PV) sector, and is expected to remain a key growth driver despite potential cost-sensitive substitution in PV and electric vehicles (EVs). Traditional industrial applications of silver continue to show stable demand irrespective of price fluctuations.

Investment demand is also on the rise, amid the geopolitical uncertainties and investor preference for tangible assets. Coins, bars, and exchange-traded products (ETPs) are forecasted to grow at high single-digit rates. Meanwhile, India is emerging as a major source of future demand, with industrial usage expected to rise significantly due to expanding applications in EVs, 5G, and other advanced technologies.

Hindustan Zinc (HZL), the world’s 4th largest silver producer, continued to play a pivotal role in the global silver market. In FY 2024-25, the Company produced 687 tonnes of silver. Responding to surging global and domestic demand, HZL is actively enhancing its production capabilities to strengthen its position and support the evolving market.

Global oil market experienced moderate growth in both supply and demand during 2024. Non-OPEC countries led supply expansion, with the United States adding 0.7 million barrels per day (Mb/d), followed by Canada (+0.21 Mb/d), China, and Argentina. Concurrently, global oil demand rose by approximately 1.6 Mb/d, driven by increased transportation and industrial fuel consumption across non-OECD countries, as well as new refinery capacities added in China and the Middle East.

India’s oil consumption continued its upward trajectory, reaching 5.55 Mb/d in 2024, an increase of 0.21 Mb/d Y-o-Y. While the domestic economy faced a temporary slowdown, indicators suggest recovery is on track. With heightened government spending and the possibility of interest rate cuts in early 2025, India is expected to maintain a steady growth path through 2025 and 2026, albeit at a slightly moderated pace.

Crude oil prices in 2024 averaged US$ 80.8 per barrel, marking a 2% decline compared to 2023. Prices fluctuated in a narrow range of US$ 70-86 per barrel, shaped by several factors: a subdued economic outlook in major economies, steady non-OPEC+ supply, geopolitical tensions in the Middle East, and shipping disruptions in the Red Sea. OPEC+ production cuts helped stabilise the market and prevented prices from falling below the lower end of this band.

Looking ahead, OPEC projects global oil demand to grow by 1.5 Mb/d in 2025, reaching 105.2 Mb/d. This growth will be led by strong aviation fuel demand, increased road transport usage, and sustained industrial and agricultural activity in non-OECD nations. Supply from non-OPEC countries is expected to increase by 1.1 Mb/d, with the United States, Canada, Brazil, and Norway contributing the most.

However, several risks remain. The ongoing Russia-Ukraine conflict and intensifying trade tensions could disrupt supply and affect pricing dynamics. According to the US Energy Information Administration (EIA), Brent crude prices are forecast to average US$ 74/b in 2025, reflecting an easing of OPEC+ cuts and stronger production outside the alliance. In this context, trade friction and geopolitical developments will remain key variables influencing the market.

India is poised to play a larger role in shaping global oil demand, driven by rapid urbanisation, rising disposable incomes, and a growing population. Its oil consumption is forecast to rise to 5.8 Mb/d in 2025, buoyed by increased airline traffic and steady GDP growth.

Cairn India, one of India’s leading private oil and gas exploration and production companies, holds gross proven and probable reserves of 1,430 million barrels of oil equivalent (mmboe). Its crude oil is supplied to both public and private refineries, while natural gas supports the fertiliser, city gas distribution, and industrial sectors.

In FY 2024-25, 100% of Cairn’s crude oil and gas output was sold within India, in alignment with domestic regulatory requirements.

Global steel demand is set for a modest recovery from late 2025, driving increased iron ore consumption. This growth will be led by emerging Asian markets and infrastructure-focussed economies such as India and the Middle East. Global steel demand is projected to grow by 1.2% annually, supported by infrastructure investments and manufacturing expansion across South Asia, Southeast Asia, and North America.

Iron ore prices experienced significant volatility in late 2024, rising nearly 20% to around US$ 105 per tonne following policy announcements from China aimed at stimulating growth.

On the demand side,

The global steel and iron ore markets are positioned for recovery, driven by infrastructure spending and economic stimulus measures. India emerges as a critical growth engine, with steel demand expected to rise by 8% in 2025, underpinned by strong infrastructure development and supportive government policies. Steel production in India is projected to reach 152 million tonnes by FY 2024‑25, pushing domestic iron ore demand up by 9% to 255 million tonnes.

As the world’s second-largest steel producer, India’s expanding capacity and robust momentum will significantly influence global iron ore dynamics, even as other regions face oversupply and price pressures.

The Company has strengthened its position as a leading producer of iron ore and pig iron. It achieved key production milestones in FY 2024-25, including 5 million tonnes of iron ore from Karnataka, 4.2 million tonnes from Odisha, and 1.3 million tonnes from Goa mines following their reopening. Additionally, over 819 kilo tonnes of pig iron were produced, reinforcing its role in supporting industrial growth and maintaining sector leadership.

India’s power sector made notable progress in 2024, marked by a record power demand reaching 250 GW and continued improvements in energy infrastructure. Electricity generation grew by 4.89% compared to the previous fiscal year, reaching approximately 1,667.6 billion units in FY 2024-25 (tentative figures as of February 2025). Total installed capacity expanded robustly to 470 GW by February 2025.

Significant strides were made in renewable energy, with an additional 129 GW capacity added since 2014, complementing the expansion of thermal power to meet the rising electricity demand. The government’s initiatives, such as universal electrification, enhanced rural power availability, and energy conservation efforts, reinforce India’s trajectory toward becoming a global energy leader.

Supporting this growth, revised Right of Way (RoW) guidelines have been introduced to facilitate transmission infrastructure aimed at integrating 500 GW of renewable energy by 2030, underscoring the commitment to a sustainable power future.

India’s power demand is propelled by macroeconomic factors, including a population projected to reach 1.5 billion by 2030 and accelerating urbanisation. Per capita electricity consumption increased to 1,395 kWh in 2024-25, a 45.8% rise since 2013‑14, though it remains about one-third of the global average, indicating significant growth potential.

For FY 2024-25, India targets electricity generation of 1,900 billion units, up 9.3% from 1,738.8 billion units the previous year. The generation mix includes 1,445 billion units from thermal power, 148 billion from hydro, 55 billion from nuclear, 8 billion through imports (mainly Bhutan), and 244 billion from renewable sources excluding large hydro.

Fossil fuel-based plants, primarily coal and lignite, contribute 248 GW (52.6%) of installed capacity, while non-fossil sources such as renewables and nuclear account for 223 GW.

Electricity availability has improved substantially, with rural areas receiving an average of 21.9 hours per day, up from 12.5 hours in 2014. Urban areas average 23.4 hours daily. Round-the-clock tariffs in the Day Ahead Market for FY 2024-25 stand at ₹ 4.435 per kWh, reflecting stable power pricing.

Vedanta Group is well-positioned to capitalise on India’s expanding power sector with a diversified portfolio of around 12 GW, spanning both Independent Power Producers (IPP) and Captive Power Plants (CPP). It ranks as the second-largest private power player in India.

Within the IPP segment, Vedanta is the fourth-largest private player with 4,780 MW capacity, including major assets such as Talwandi Sabo Power Limited (1,980 MW) and Jharsuguda plant (600 MW). The Company’s growth pipeline includes the upcoming Meenakshi Energy Limited (1,000 MW) and Vedanta Limited Chhattisgarh Thermal Power Plant (1,200 MW).

India cemented its position as the world’s second-largest steel producer in FY 2024-25, achieving finished steel production of 145.3 million metric tonnes (MMT). This marked a robust Y-o-Y growth of 4.4%, reflecting resilience amid a global economic slowdown, ongoing trade tensions, and subdued demand from China.

A key driver of domestic steel consumption has been the Indian government’s strong focus on infrastructure development. Flagship initiatives such as the National Infrastructure Pipeline (NIP) and the PM Gati Shakti National Master Plan (NMP) have accelerated demand, helping push India’s per capita steel consumption closer to 100 kg. The National Steel Policy aims to elevate this further to around 158 kg by FY 2030-31, signalling significant growth potential.

Despite this positive domestic momentum, global steel prices softened due to weak demand worldwide, surplus steel availability from China, and easing raw material costs. Consequently, India remained a net importer of finished steel, with imports rising to 9 MMT between April 2024 and March 2025 — a 16% increase compared to the previous year. This surge has placed downward pressure on domestic steel prices. To address rising imports and associated trade tensions, a proposal for a 12% safeguard duty on select steel products for 200 days has been tabled.

India’s government is steadfast in its commitment to reaching a steel production capacity of 300 MMT by 2030. This ambition is backed by a 10% increase in capital expenditure for FY 2025-26, with a budget allocation of ₹ 11.2 lakh crore.

Driving this growth are the country’s goals to become a US$ 5 trillion economy through initiatives like “Make in India,” Multi-Modal Corridors, Pradhan Mantri Awas Yojana (housing for all), and Production-Linked Incentive (PLI) schemes. Rising incomes, rapid urbanisation, and ongoing infrastructure development are expected to sustain strong steel demand.

For FY 2025-26, key sectors including infrastructure, construction, and automotive remain priorities. Plans include building 20 million new houses under PM Awas Yojana over five years, sanctioning three new Economic Corridors under PM Gati Shakti, expanding airport infrastructure through the UDAN scheme, and extending the Jal Jeevan Mission till 2028.

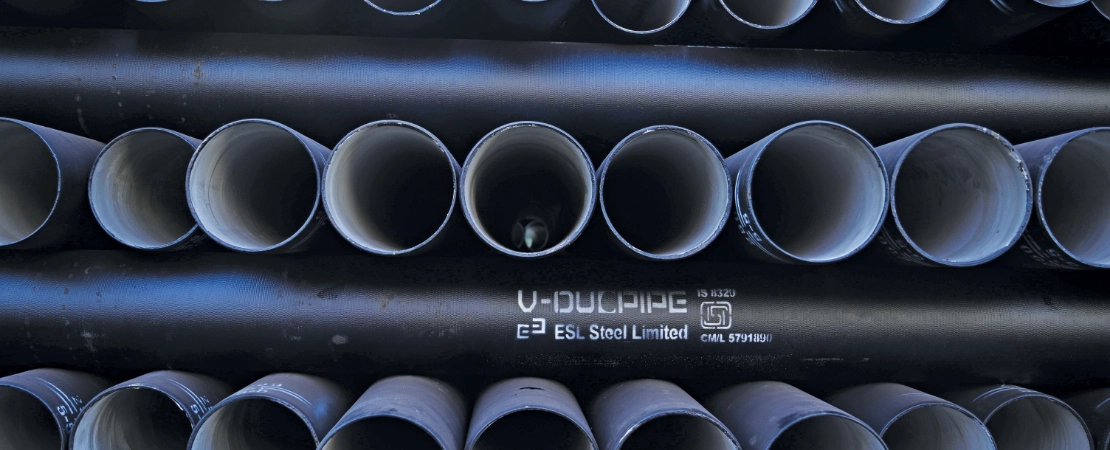

ESL Steel Limited offers a broad product range including TMT bars, wire rods, ductile iron pipes, billets, and pig iron. Its strategic presence and diversified portfolio position it well to benefit from rising demand in construction, infrastructure, and manufacturing.

In FY 2024-25, ESL recorded finished sales of approximately 1.34 million tonnes, driven by strong domestic demand and record project sales, leading to its lowest closing stock of TMT bars and wire rods. The Company prioritised value-added products, with 85% of wire rod sales in high carbon and alloy grades, introduced new grades, and doubled sales in the Cold Rolled Steel segment. It also expanded its TMT offering to include 40 mm diameter bars.

ESL Steel Limited aims to capitalise on growth opportunities by focussing on alloy segment sales, optimising its product mix, and broadening wire rod diameter ranges to maximise revenue. Despite global challenges such as price volatility and trade issues, the Company’s focus on innovation, digitalisation, and operational efficiency supports its growth ambitions. ESL remains committed to contributing to India’s steel self-sufficiency as infrastructure development and economic expansion continue to drive the sector forward.

High Carbon Ferro Chrome (HCFC) plays a critical role in stainless steel manufacturing, where it enhances durability, corrosion resistance, and high-temperature performance. Over 85% of global HCFC production is consumed by the stainless-steel industry, making its demand closely tied to the health of this sector.

Asia, led by China, dominates the global HCFC market, accounting for nearly 85% of consumption and controlling significant chromite ore reserves – HCFC’s primary raw material. While South Africa remains the largest supplier of chromite ore, China’s scale in HCFC production positions it as a key influencer in global pricing and supply trends.

India continues to strengthen its role in this market, emerging as the fourth-largest producer globally with an output of approximately 1.4 million tonnes in CY 2024. India’s HCFC industry is predominantly export-oriented, with around 60% of production shipped overseas.

However, from the second half of FY 2024-25, HCFC prices faced downward pressure due to soft demand in China and Europe, coupled with falling ore prices. Domestic prices in India mirrored this decline but remained slightly higher than Chinese levels. Looking ahead, the trend is expected to reverse from mid-Q4 of FY 2024-25, with prices likely to stabilise and strengthen in early FY 2025-26 as stainless steel demand recovers both globally and within India.

The near-term outlook for HCFC is positive, supported by a projected 4–5% global increase in stainless steel production. This growth is expected to be driven by infrastructure development in emerging economies and a demand rebound from China.

India is poised to outpace global trends, with HCFC and stainless-steel production projected to grow at 7–8% in FY 2025-26. This acceleration is underpinned by large‑scale infrastructure investments and a rise in per capita stainless-steel consumption, signalling sustained domestic demand for HCFC.

Ferro Alloys Corporation (FACOR) is a leading player in India’s HCFC sector, ranked as the fourth-largest domestic supplier. In FY 2024-25, FACOR directed 87% of its HCFC output to serve stainless steel and alloy steel producers in India, underscoring its strategic domestic focus in a predominantly export-led industry.

FACOR is also advancing its Value‑Added Products (VAP) portfolio to tap specialised markets in Europe and South Korea. As part of its FY 2025‑26 strategy, the Company is targeting higher production volumes and expanded presence across domestic and global markets.

Our Ferroalloy business remains focussed on capacity expansion, deeper domestic market engagement, and scaling our VAP offerings –positioning us strongly to grow in an evolving global HCFC landscape.

FY 2024-25 was a dynamic year for the copper market. Prices reached record highs in Q1 before softening in the following quarters, only to recover again in Q4, supported by stimulus measures announced by China.

Domestic copper demand continued to grow at a CAGR of 7%, driven by the accelerating electrification of transport, increased construction activity, and industrial growth supported by Production-Linked Incentive (PLI) schemes. Rising sales of consumer durables such as air conditioners and electronics further boosted demand.

A key development during the year was the shift in India’s import mix. Semi-finished copper imports (e.g., cathodes) declined by 7% as manufacturers increasingly opted for blister copper – supported by the removal of customs duty in the Union Budget 2024 – favouring higher value-added domestic processing.

India’s copper demand is expected to reach 3 million tonnes by CY 2030, with a projected 7% growth in FY 2025-26. Several trends underpin this trajectory:

The Company remains a leading player in India’s copper industry, supported by its broad product portfolio, customer-focussed approach, and innovation-led strategy. It caters to diverse segments including housing wires, winding wires, cables, transformers, and electrical profiles.

Holding a strong 20% domestic market share, the Company is actively expanding its export footprint, targeting neighbouring countries and Gulf markets. Its ongoing focus on green copper production – incorporating sustainable practices and efficient technologies – reinforces its long-term competitiveness and commitment to responsible growth.

Well-aligned with national priorities and global trends, the Company is poised to capitalise on the sector’s growing potential in FY 2025-26 and beyond.